Why Do Traditional Fraud Rules Fail Today?

Most fraud detection systems were built on rule engines. If user does X, flag it. If transaction looks abnormal, block it. These rules still help, but fraud patterns evolve faster than humans can write rules.

The main issues you feel immediately:

- Traditional rules do not spot subtle anomalies.

- They misfire on good customers and raise false alarms.

- Fraudsters use bots and coordinated attacks, which rules cannot predict.

Your risk teams end up spending hours reviewing alerts that do not matter. Customers complain. Money is lost quietly. This is why the shift to cloud based systems matters.

What Makes Cloud Platforms Ideal for Real Time Fraud Detection?

Cloud is not just a place to store your data. It gives you compute, serverless pipelines, feature stores, streaming analytics, and tools for model training. All integrated. All scalable.

Key advantages:

- Elastic compute for training heavy models.

- Real time data streaming that pushes updates within milliseconds.

- Security and compliance baked into the platform.

Think of it like renting a fully equipped lab instead of building your own.

How Do You Collect and Organize the Right Data for Fraud Detection?

Your AI models are only as strong as the data you feed them. So data design comes before modeling.

You typically need:

- Behavioural signals

- Transaction patterns

- Device fingerprints

- IP and geo activity

- Historical fraud labels

Velocity metrics

Which AI Techniques Work Best for Real Time Fraud Prevention?

Fraud is dynamic. So your model needs to adapt.

Most teams rely on a mix of techniques instead of a single one:

- Anomaly detection

- Classification models

- Graph based models for ring detection

- Time series models for transaction velocity

How Do You Train and Deploy AI Models on the Cloud?

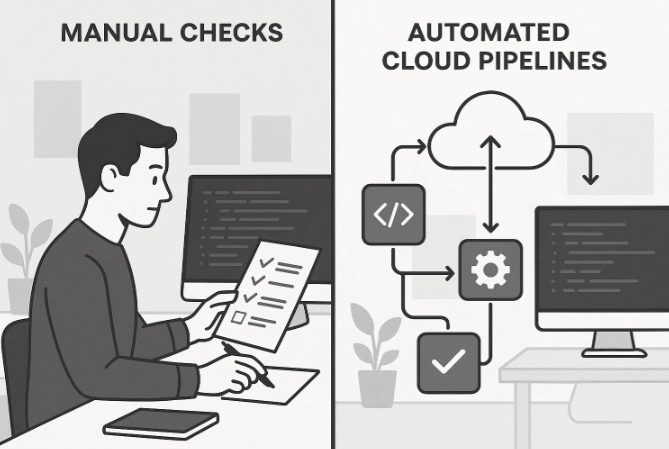

This is where many companies get stuck. Training a model is one thing. Making it work in real time is another.

A typical workflow on cloud looks like this:

- Data is cleaned and pushed to a feature store

- Model training begins with auto scaling compute

- Validation ensures the model is safe to deploy

- A deployment pipeline publishes the model to an endpoint

- The endpoint serves predictions within milliseconds

How Do You Continuously Improve Your Fraud Models?

Fraud patterns shift every week. So your model cannot remain static. You need a loop:

- Collect new fraud cases

- Push to training datasets

- Retrain model

- Evaluate performance

- Deploy new version

This loop can run daily or weekly depending on your risk appetite.

Example:

A marketplace platform uses an automated retraining pipeline. When fraud agents label a new fraud case, the system learns from it in the next retraining cycle.

Cloud makes this easier because retraining jobs can run automatically and cost only when used.

Where Do Most Companies Fail When Building Fraud Models?

Common issues include:

- Not collecting enough labelled fraud data

- Choosing the wrong model type

- Slow inference that breaks the user experience

- Ignoring compliance requirements

- Failing to monitor drifts in real behaviour

Most problems come from not planning the data architecture early. Once that is fixed, everything else gets easier.

How Does Cloud Security Support Fraud Prevention?

Security matters because fraud detection systems handle sensitive information.

Cloud providers offer:

- Encryption by default

- Role based access

- Compliance certifications

- Private network routing

This ensures your model does not leak sensitive customer data.

What Should You Build First If You Are Starting Today?

Do not try to build everything. The best place to start is usually:

- One core model

- One streaming pipeline

- One clear feedback loop

This gives you a working foundation. You can scale it gradually.

How Does Real Time Fraud Prevention Impact Customer Experience?

Fraud detection should protect customers without annoying them.

- If the system is too aggressive, good users get blocked.

- If it is too slow, they abandon the checkout.

- If it is inaccurate, support teams get overwhelmed.

AI models reduce false positives because they understand patterns, not just rules. This improves customer trust and reduces churn.

What Will Fraud Prevention Look Like in the Next Two Years?

Fraud continues to evolve. Attackers use automation, bots, deepfakes and synthetic identities. The next wave of fraud prevention will rely heavily on:

- Adaptive models that learn within minutes

- Graph analysis to detect ring patterns

- Behavioural fingerprints

- Serverless fraud engines that scale instantly

Cloud makes these innovations practical because you only pay for what you use.

Final Thoughts

Real-time fraud prevention isn’t about chasing hype; it’s about building systems that act before losses occur. Modern cloud platforms make this practical by letting you train and deploy AI models without massive infrastructure overhead. The real work starts with clean data pipelines, a simple baseline model, and a low-latency deployment path — then improving that model continuously as fraud patterns evolve. Fraud adapts relentlessly, and your models must evolve just as fast.

admin

Product Designer